January 27, 2025 by Cormint

FINANCIAL UPDATE - FULL YEAR 2024 RESULTS

Fort Stockton, Texas – Jan 27th, 2025 – Cormint Data Systems, Inc. (“Cormint”), a West Texas based Bitcoin miner built to be America’s lowest cost producer of Bitcoin, announced today its unaudited financial results for Q4 2024.

| Financials in USD | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | FY 2024 (5) |

|---|---|---|---|---|---|

| Nameplate Hashrate (1) | 1.5 EH/s | 1.5 EH/s | 3.2 EH/s | 3.2 EH/s | 3.2 EH/s |

| BTC Mined | 147 | 113 | 103 | 134 | 496 |

| Revenue | $7.8mm | $7.5mm | $6.3mm | $11.1mm | $32.7mm |

| Power Price Achieved | 2.1c kWh | 1.7c kWh | 3.5c kWh | 1.8c kWh | 2.3c kWh |

| Power Expenses per BTC | $10,749 | $14,479 | $44,999 | $25,428 | $22,754 |

| Gross Margin | 80% | 77% | 26% | 70% | 66% |

| Admin Expenses per BTC | $13,378 | $18,596 | $19,577 | $11,105 | $15,100 |

| Operating Expenses per BTC (2) | $24,127 | $33,751 | $64,576 | $36,533 | $37,855 |

| Mining Operating Profit (3) | $4.3 | $3.7m | ($0.4m) | $6.3m | $13.9m |

| Mining Operating Margin | 55% | 49% | (6%) | 56% | 44% |

| Unlevered Net Income (4) | $1.7m | $0.8m | ($3.6m) | $2.7m | $1.4m |

(1) Deployed as at period end

(2) Operating Expenses includes electricity and administrative costs. It excludes items such as stock-based compensation, depreciation, interest, and Gain/(Loss) on Bitcoin Held or Derivatives.

(3) Mining Operating Profit is Revenue less Operating Expenses, and thereby provides a proxy for underlying cash flow generation from mining operations

(4) Unlevered Net Income includes all revenue, and all expenses (cash and non-cash items such as depreciation), but excludes those items which are a function of its capital strategy namely, the PnL from HODLing Bitcoin and Debt. If the business were to be entirely equity funded, and to immediately sell down all Bitcoin earnt, then Unlevered Net Income would be equal to Net Income.

(5) The sum of quarterly numberes may differ to the annual result due to rounding.

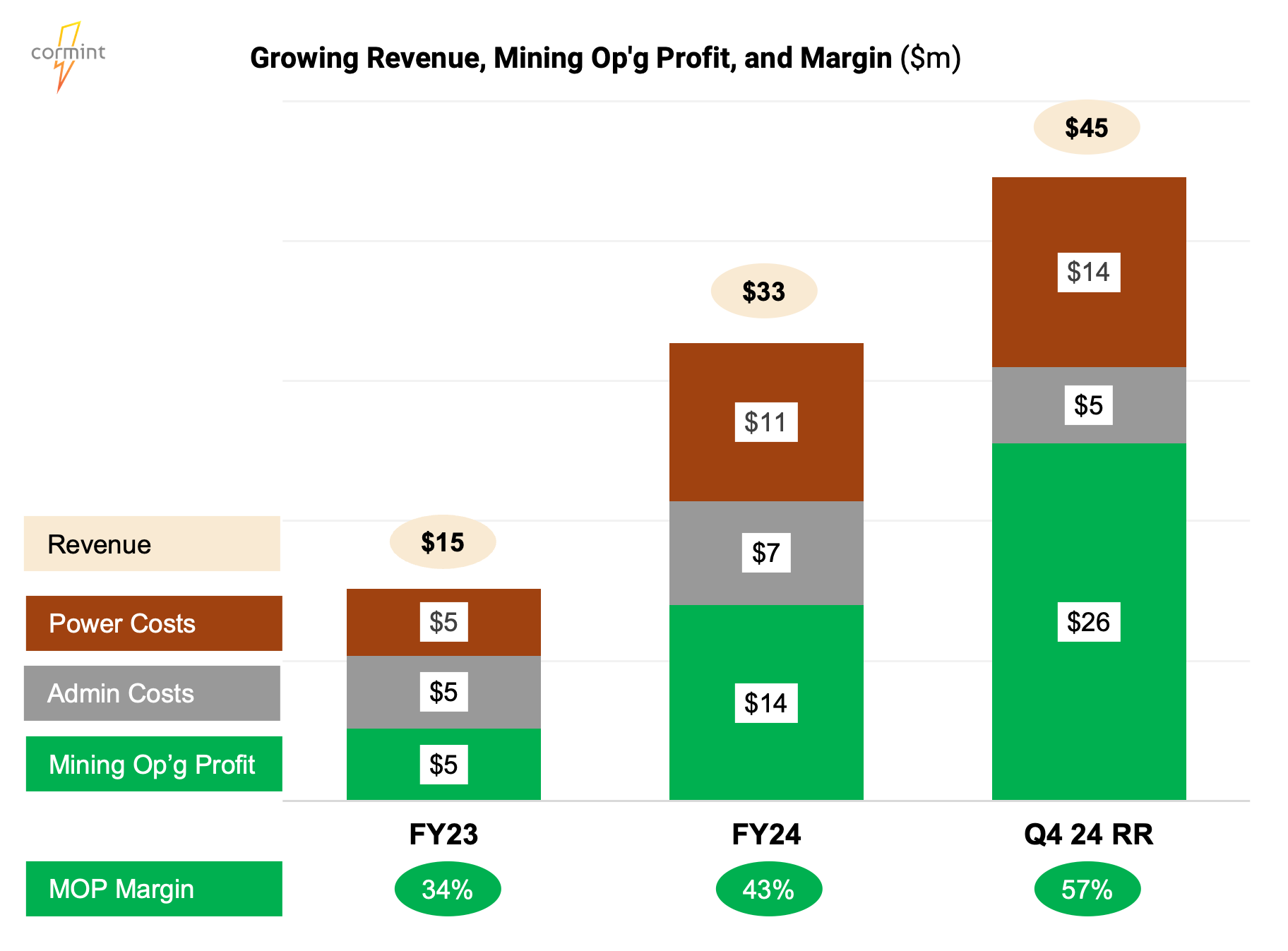

Cormint’s Q4 2024 results were outstanding with the business exceeding expectations across power, engineering and capital markets. With Q4 Power Price of 1.8c/kWh and full year 2024 of 2.3c/kWh Cormint continued its market leading results in power, enhanced by its growing capabilities in power trading. Administrative costs have remained tightly controlled such that the benefits of additional scale have accrued to the bottom line. Operating Expenses per BTC for the year remained consistently below Bitcoin Price. Mining Operating Profit has grown consistently over the past 12 months with FY24 exit run-rate exceeding forecast. Looking back to 2023, Cormint has now consistently grown each of Revenue, Mining Operating Profit, and Operating Margins as the business has scaled.

For the full year 2024, Cormint also delivered a positive Unlevered Net Income. This metric is monitored keenly in the company as it considers depreciation and allows the operating profitability of the business to be examined as distinct from Net Income which additionally considers the implications of its capital strategy. While Cormint would welcome another rally in Bitcoin price in 2025, its business is built to deliver attractive returns to its investors in all conceivable market conditions.

From a capital perspective, we exited 2024 with 822 Bitcoin on the balance sheet and a sophisticated hedging program. Early in January 2025, the Company exercised its right to prepay in part its Bitcoin Denominated Notes, with 650 Bitcoin being returned to lenders. This decision to partially prepay the Notes was made possible by the rapid accumulation of Bitcoin from operations as Cormint has mined Bitcoin at a discount to its market value. By lowering the total outstanding balance ahead of schedule, and taking advantage of new funding sources, Cormint has enhanced its financial flexibility - putting the company in a strong position to pursue new growth opportunities.

Cormint retains its ambition to have 500MW under management by the end of 2026 and expects to imminently make further disclosures on its second Texas site. As always, we remain focused on delivering returns on capital deployed to ensure that any investment will exceed our cost of capital in all conceivable market conditions and that we deliver a return to equity investors materially greater than what they would otherwise achieve through a passive allocation to Bitcoin.

For more information, please visit www.cormint.com or contact us.

Contact: [email protected]

Please note that this press release is for informational purposes only and it does not represent an offer to sell or the solicitation of an offer to buy any of Cormint’s securities.

This press release contains a number of forward-looking statements. Words such as “expect,” “will,” “working,” “plan” and variations of such words and similar future or conditional expressions are intended to identify forward-looking statements. These forward-looking statements reflect Cormint’s current views with respect to, among other things, future events. These forward-looking statements are not guarantees of future results and are subject to a number of risks and uncertainties, many of which are difficult to predict and beyond Cormint’s control. Important factors that may cause actual results to differ materially from those in the forward-looking statements include, but are not limited to Cormint’s ability to deliver and execute on its strategic plans; Cormint’s ability to maintain free cash flows and increase its operating margins and other risks related to Bitcoin mining.